A Defined Benefit (DB) pension is a group-styled retirement plan where employers and employees contribute to a pool of funds that is invested on behalf of employees.

The asset base generated by the contributions and investment returns, is used to pay the employee a lifetime benefit upon retirement based on wages, service, and age.

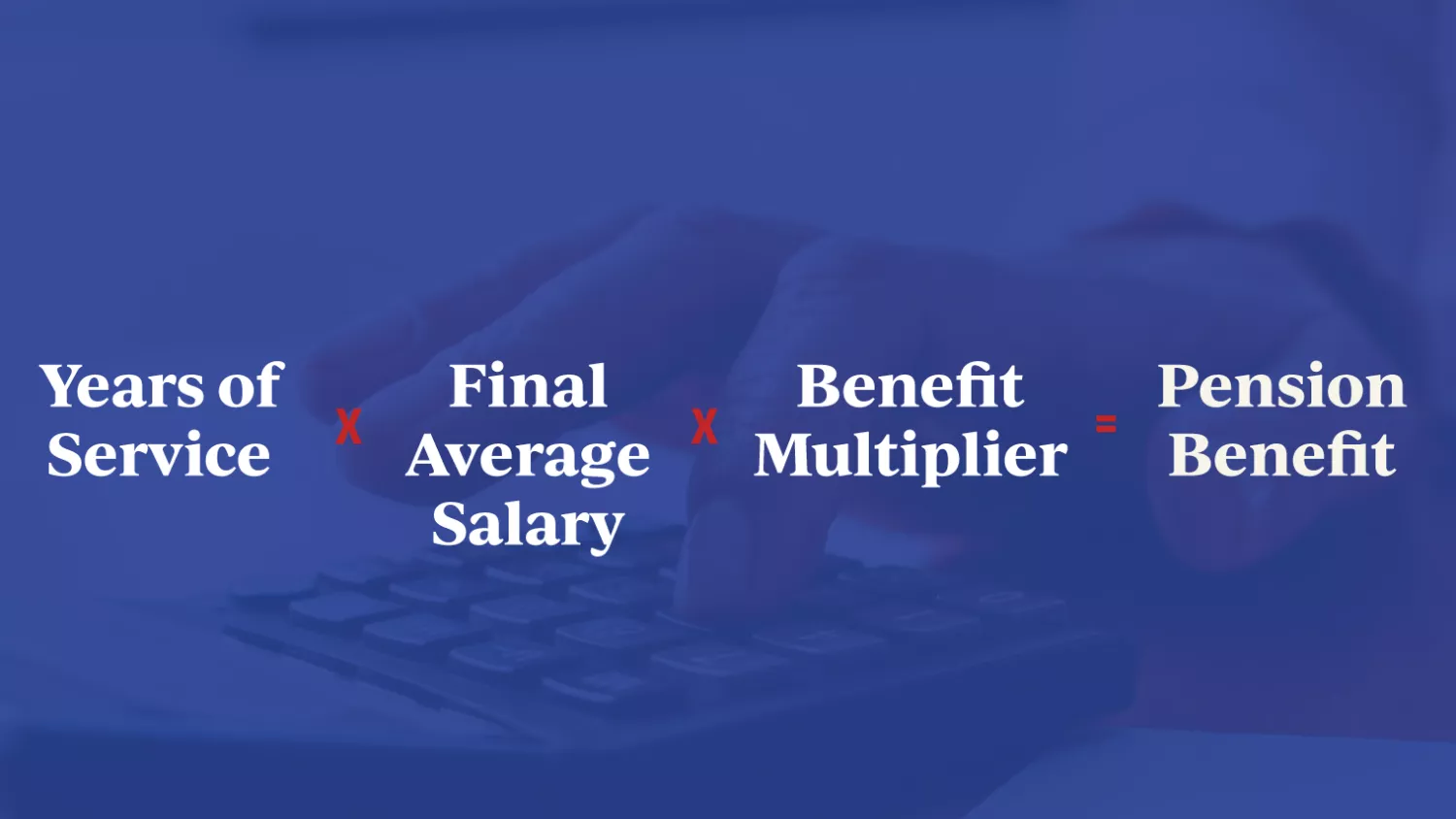

Employees eligible for retirement can estimate their benefit level by using a formula that is typically structured as: years of service times their final average salary times the benefit multiplier.

The multiplier is a percentage that often ranges from 1% to 2.5% and determines the size of the benefit amount. The formula can be adjusted to increase or decrease the benefit.

Defined Benefit pensions provide fixed, modest monthly payments to retired employees.

Pensions offer relatively low fees, asset diversification, longevity risk pooling, and professional management.

Many DB plans offer disability benefits in the event members become disabled and cost-of-living adjustments (COLAs).

Because of these advantages, pensions provide better retirement benefits for about half the cost of 401(k)-styled defined contribution (DC) plans.

Other Types of Retirement Plans

Defined Contribution (DC) plan: A benefit plan like a 401(k) or a 403(b) is an employee-sponsored retirement savings plan.

Employees bear the investment and longevity risks and choose their contribution levels. Like pensions, the employee contributions are made on a pre-tax basis.

Unlike pensions, retirement benefit levels are not guaranteed and are dependent upon how much employees contribute and the investment performance.

There are no cost of living adjustments (COLAs) or disability benefits.

Downloads

Use Your Educator Voice.